Denmark boasts a well-regulated and relatively liberalized gambling market, including sports betting. This framework aims to balance consumer protection, prevention of illegal activities, and the provision of a competitive environment for operators. The Danish Gambling Authority, known as Spillemyndigheden, under the Ministry of Taxation, is the central body responsible for overseeing all gambling activities, including issuing licenses, regulating operators, and ensuring compliance with the country’s gambling laws.

Table of Contents

ToggleHistorical Context

Denmark has a long history of legal gambling, with the first state lottery established in 1948. However, the modern era of gambling regulation was significantly shaped by the Danish Gambling Act of 2012. This act marked a pivotal shift by liberalizing the online gambling market, including online casino games and sports betting. Before this, the state-owned Danske Spil held a near-monopoly. The 2012 Act allowed private operators, both domestic and international, to apply for licenses and compete in the Danish market, fostering a more dynamic landscape.

Licensing Regime for Sports Betting

The Danish Gambling Act mandates that any operator wishing to offer sports betting licensed in Denmark services to Danish residents must obtain a license from Spillemyndigheden. There are primarily two types of licenses relevant to sports betting:

Online Betting License:

This license permits operators to offer games where participants wager on the outcome of sporting events.

This includes both fixed-odds betting and pool betting. In-play betting is allowed under this license, but operators must adhere to strict controls, including thorough player verification and the implementation of responsible gambling tools.

Land-Based Betting License:

While the online market is liberalized, physical betting shops still require a separate license. These licenses are granted under the broader framework of land-based gambling regulations.

Licenses are typically issued for a period of five years and are renewable, provided the operator continues to comply with Danish regulations.

Requirements for Obtaining a Sports Betting License

The licensing process in Denmark is rigorous and involves thorough checks to ensure the suitability and capability of applicants. Key requirements include:

Financial Stability: Applicants must demonstrate that they possess the financial resources to conduct their operations responsibly and meet potential payouts. Financial audits and detailed business plans are typically required.

Professional Competence: Operators must show that they have the necessary expertise and organizational structure to manage a sports betting business in a compliant and responsible manner.

Integrity: Background checks are conducted on the applicant and key personnel to ensure they have no criminal records or affiliations that could compromise the integrity of the gambling operations.

Responsible Gambling Measures: A crucial aspect of the licensing process is the demonstration of robust, responsible gambling policies and tools. This includes measures for age verification (minimum age is 18), deposit limits, reality checks to inform players about their time spent gambling, options for self-exclusion (through the national ROFUS register), and clear responsible gambling messaging in advertising.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Procedures: License holders must implement strict AML and KYC regulations. This involves conducting due diligence on customers, monitoring transactions for suspicious activity, and reporting to Spillemyndigheden when necessary.

Data Security and Player Protection: Operators must have secure systems in place to protect player data and ensure the fairness and transparency of their betting offerings.

Payment of Fees: Applicants are required to pay an application fee, and licensed operators must also pay an annual fee based on their gross gaming revenue (GGR). As of the latest information, the application fee for an online sports betting license is DKK 290,600, with an annual fee of DKK 56,500 plus a percentage of the GGR.

Taxation of Sports Betting

Licensed sports betting operators in Denmark are subject to taxation on their gross gaming revenue (stakes minus winnings). The tax rate for betting has been reported to be around 20% of the GGR. It’s important for operators to register under the Danish Act on Taxes on Gambling and comply with the tax regulations set by the Danish Tax Agency.

It is important to note that the tax framework can evolve, and operators should stay informed about the current regulations. Gambling winnings for individual players are generally not taxed in Denmark if the betting is conducted through a licensed operator within the country.

Responsible Gambling in Denmark

Denmark places a strong emphasis on responsible gambling. Spillemyndigheden actively monitors licensed operators to ensure compliance with responsible gambling requirements. Key initiatives include:

- ROFUS (Register Of Voluntarily Excluded Players): This national self-exclusion program allows individuals to ban themselves from all licensed gambling platforms in Denmark for a specified period or permanently. Licensed operators are legally obligated to check this register before allowing anyone to gamble.

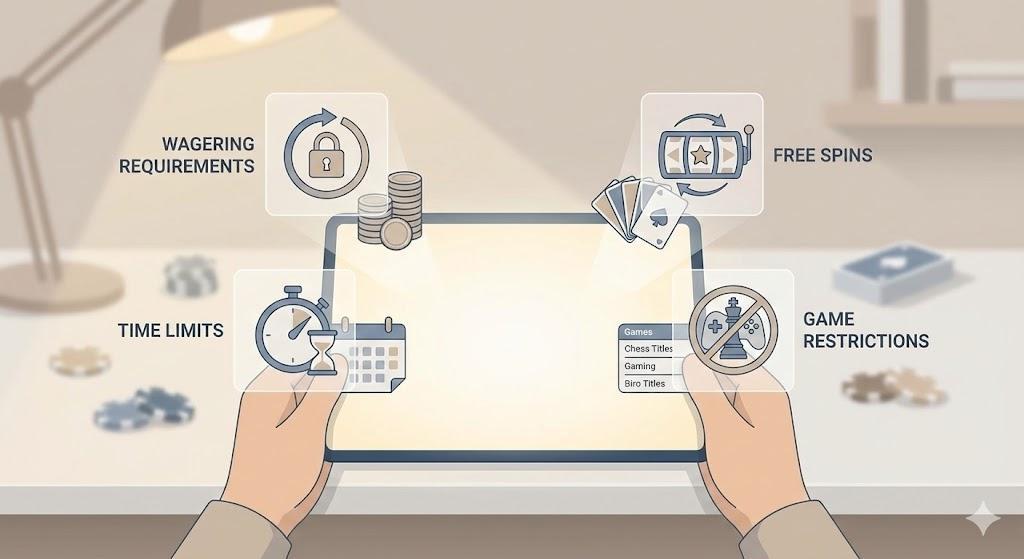

- Mandatory Tools: Operators must offer players tools such as deposit limits, reality checks, and breaks from play.

- Advertising Regulations: There are rules in place regarding the advertising of gambling services, with a focus on responsible messaging and preventing the targeting of vulnerable individuals, especially minors.

- Blocking of Illegal Websites: Spillemyndigheden actively works with internet service providers (ISPs) to block access to gambling websites operating without a Danish license. Payment providers are also required to prevent transactions to and from these illegal sites.

The popularity of Sports Betting in Denmark

Sports betting is a popular pastime in Denmark, and a significant portion of the gambling market is attributed to it. The liberalized online market has provided consumers with a wide range of options and competitive odds. Mobile betting accounts for a substantial share of the sports betting revenue, indicating the prevalence of online and mobile platforms. While online casinos currently generate the largest share of the total gambling revenue in Denmark, sports betting remains a significant contributor.

Conclusion

The licensing framework for sports betting in Denmark, overseen by Spillemyndigheden, is designed to create a regulated, safe, and competitive environment. The stringent requirements for obtaining and maintaining a license focus on financial stability, integrity, and, crucially, responsible gambling practices. This comprehensive approach aims to protect consumers while allowing licensed operators to offer their services within a clear legal framework. The Danish model is often cited as an example of a well-structured and effective gambling regulatory system in Europe.