Betting site operators face overwhelming challenges with player verification. Each country enforces unique identity verification rules that change frequently. Modern Full Casino Solution providers must address these regional variations while maintaining strong security standards. Without properly designed KYC systems, operators struggle to expand internationally or risk substantial regulatory penalties.

Many platforms force operators to choose between rigid verification processes that frustrate players or relaxed standards that invite regulatory problems. Neither approach works in today’s complex compliance environment.

The iGaming industry has evolved dramatically in recent years. Regulatory bodies now scrutinize player verification far more closely than game fairness or financial controls. This shift requires fundamental changes to how platforms handle identity verification.

Table of Contents

ToggleThe Compliance Challenge

Technical directors know that KYC implementation isn’t just about scanning documents. Different jurisdictions require completely different approaches. UK authorities demand full verification before any gameplay. Malta permits limited betting with minimal verification, requiring additional checks as deposit amounts increase. Nordic countries require integration with national electronic ID systems. These conflicting requirements create enormous technical challenges for platform designers.

Full Solution architecture must incorporate distinct verification pathways for each supported market. The underlying system needs to maintain comprehensive verification records while providing operators with flexible implementation options. This balancing act between security, compliance and user experience represents one of the most difficult aspects of platform development.

Most betting platforms on the market today use hardcoded verification sequences. Each regulatory change requires developer intervention, creating bottlenecks that slow market entry. Operators using these platforms often face months of development work when expanding to new regions.

Modular Verification Architecture

Advanced platform providers address these challenges through component-based KYC systems. Engineers design independent verification modules that operators can arrange into region-specific flows. The best systems include components for document scanning, facial biometrics, address verification, PEP (politically exposed person) screening, and other specialized checks.

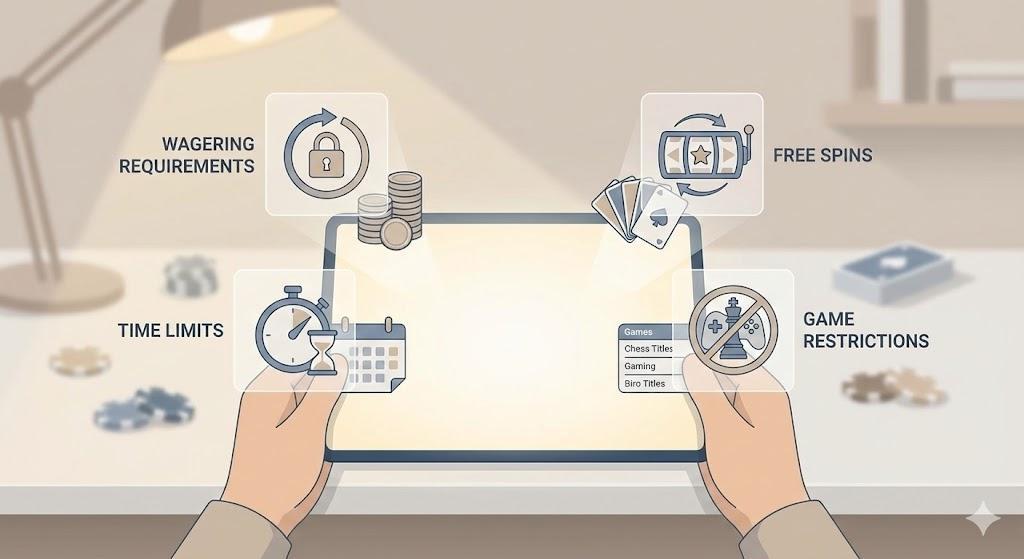

These modules connect through workflow engines that support complex decision paths. Operators define verification sequences tailored to each market’s requirements. The system executes these workflows automatically, guiding players through appropriate verification steps based on their location, deposit amount, and risk profile.

Technical Implementation

Behind the scenes, advanced KYC systems employ sophisticated data handling techniques. The verification engine evaluates player information against configurable rule sets. Each completed check generates status data that affects subsequent verification steps. Document scans extract structured information for automatic comparison against player-provided details.

Database design plays a crucial role in this architecture. Player records must maintain comprehensive verification histories while supporting quick retrieval during gameplay. The system logs timestamps, verification methods, results, and document references for each completed check. This creates audit trails that satisfy regulatory requirements and support risk analysis.

Effective platforms separate verification configuration from core code. Operators adjust verification requirements through administration panels rather than requesting code changes. This approach dramatically reduces the technical overhead of entering new markets or adapting to regulatory updates.

Operational Advantages

This flexible approach delivers substantial benefits for betting operators. Compliance teams can update verification requirements without developer assistance. New regulatory mandates can be implemented in days rather than months. Technical resources focus on platform enhancements rather than constant compliance adjustments.

Companies implementing these systems report 35-45% faster market entry when expanding internationally. Conversion rates improve significantly as verification procedures adapt to local norms. Players encounter familiar verification methods rather than processes designed for different regions.

Player Experience Benefits

Despite strengthened compliance, flexible verification actually improves player experiences. The system requests only verification steps relevant to specific circumstances. Low-risk players in permissive jurisdictions might begin with basic checks, while high-value deposits in strictly regulated markets trigger comprehensive verification.

Properly designed platforms support partial verification states, allowing limited gameplay while additional checks proceed behind the scenes. This dramatically improves conversion compared to systems requiring complete verification before any activity. Players can explore the platform while automated systems verify their information.

Risk Management Integration

Beyond regulatory compliance, advanced KYC modules provide powerful risk management capabilities. The system identifies suspicious patterns like multiple accounts using similar documents. It can impose enhanced verification for specific player segments based on deposit methods, gameplay patterns, or geographic indicators.

For multi-brand operators, these tools offer particularly valuable advantages. They can implement different verification approaches across various brands while maintaining centralized compliance records. This balances marketing requirements with regulatory obligations across diverse player segments.

The ongoing development of verification technology represents a core focus for leading platform providers. As regulatory requirements grow increasingly complex, flexible verification becomes essential for competitive betting operations in the global market.