It is not a new concept that video games might offer more value than just fun. Competitive gamers have long taken home prize money from esports, while modders have carved out careers making content for existing franchises. The introduction of play-to-earn (P2E) changed the dynamic completely: players would now be able to earn money from playing rather than only having a chance to earn money from playing. The models became part of the mainstream discussion around the boom of crypto and NFTs, with games such as Axie Infinity attracting hundreds of thousands of players in developing regions of the world who did not consider gaming a hobby, but a vocation.

At its height in 2021, Axie Infinity’s economy was producing millions in daily transactions. For many, especially in the Philippines, breeding and trading Axies was comparable to a full-time job. The promise was compelling: play a game, build assets, and then sell those assets on blockchain-backed marketplaces. Unlike traditional gaming, where items are locked within a publisher’s ecosystem, P2E offered transferable ownership, suggesting that virtual swords or pets could be as real as stocks or property.

Yet this promise carried a fragile foundation. The P2E ecosystem relied heavily on new players buying into the game to sustain those already earning. When hype slowed and token values crashed, earnings evaporated almost overnight. What looked like a sustainable economy turned out to be closer to speculative trading dressed in a gaming skin.

Where the Model Struggles

The fundamental problem with play-to-earn is balancing fun with finance. For a game to succeed long-term, it must be enjoyable in its own right. Too many P2E platforms treated the game mechanics as secondary to the economic layer, meaning once earnings fell, so did engagement. Without genuine play value, users were less gamers than workers trying to extract income.

There is also a potential concern around scalability. Blockchain transactions have fees associated with them, and several early projects faced a challenge to infrastructure when users multiplied. Also, the needed reliance on volatile cryptocurrencies made in-game economies more unstable. A sword worth $100 one day could be worth $10 the next. That sort of variability undermines the security that players gain when spending time and money on digital assets.

Conventional gaming economies, while not immune to faults, typically demonstrate more stability because they are separated. The value of a skin in Fortnite may increase or decrease based on demand, but it is not linked to the vast and uncertain world of volatile markets. This apparent stability is one of the reasons that play-to-earn has yet to persuade mainstream publishers.

There is also the cultural pushback. Many gamers bristle at the idea of financialization seeping deeper into the hobby. For them, games are meant to be escapes, not workplaces. When play becomes labor, the identity of gaming risks being diluted. The backlash to Ubisoft’s attempt to integrate NFTs into Ghost Recon highlighted this tension.

Beyond the Hype: What Could Work

Despite these challenges, dismissing play-to-earn entirely would be shortsighted. The idea of digital ownership is not going away. Players clearly value their time and investments, and the demand for secure, tradable assets is growing. The real question is how to integrate these ideas without turning every player into a gig worker.

Hybrid models are one potential avenue. Developers could create ecosystems in which players can receive rewards that are not necessarily the main driving factor but instead enhance the overall game experience. An example of this is Guild of Guardians, which promotes itself more so as a “fun-first” game, with the icing on the cake being blockchain rewards.

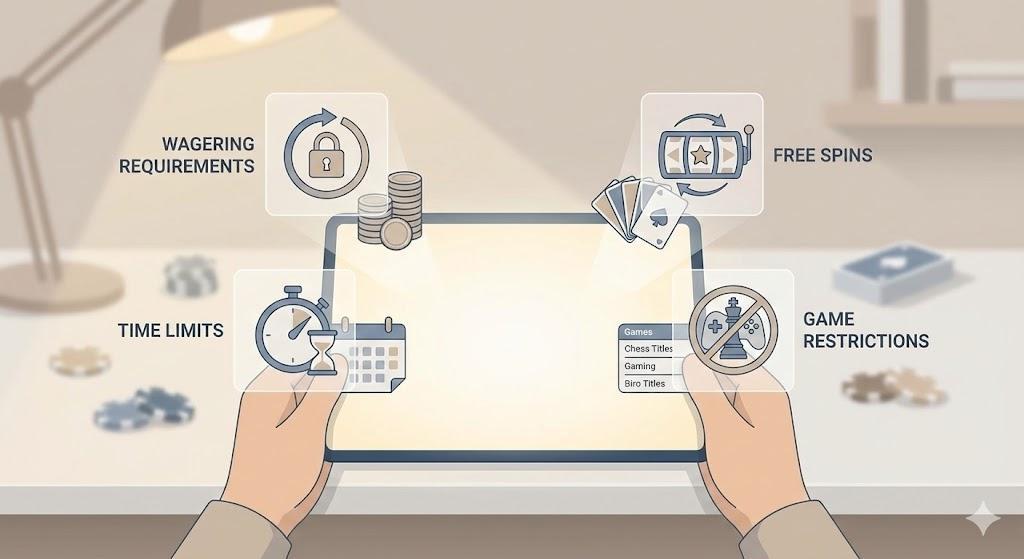

This is similar to how online casinos have changed. Rather than merely replicating brick-and-mortar casinos with the technology, several online casino platforms add in layers of bonuses, loyalty systems, and even social experiences (e.g., live dealer tables). These layers provide players an additional level of depth and engagement because they feel more like part of a multitude of engagement levers and the more complete ecosystem other than just getting paid.

Another potential direction is clarity around regulations. Governments are only just beginning to assess P2E economies, but regulations that protect players against scams while providing legitimacy to digital asset ownership would open the way for sustainable models. Much in the same way online banking and fintech matured under regulations, gaming economies might stabilize once clear rules are in place.

Finally, technology itself will assist. Layer 2 blockchain solutions, faster transaction systems, and more transparent marketplaces will help mitigate volatility and improve trust. Together with improving game design, these tools could lead to a reduction of speculation and a move toward long-term engagement in P2E.