Digital ecosystems within competitive sports simulations have evolved into sophisticated economies that mirror real-world financial systems. Developers design these environments to maximize user retention through carefully calculated scarcity and reward distribution strategies. A primary driver of this engagement is the acquisition of specific assets required for competitive advantage within the game. For instance, the strategic accumulation of resources such as FC Ultimate Team Coins determines the pace at which a user can upgrade their roster and compete at higher levels. This specific currency flow illustrates how granular economic control directly influences player behavior and long-term platform loyalty.

Table of Contents

ToggleBehavioral Psychology Behind Squad Management and Asset Accumulation

The core loop of modern sports simulations relies heavily on the psychological concept of variable ratio reinforcement. This principle suggests that unpredictable rewards generate significantly higher response rates than fixed rewards do. Players complete objectives or win matches without knowing the exact value of the reward they will receive. This uncertainty creates a powerful dopamine response that encourages continuous play sessions. Consequently, the user remains engaged for extended periods in hopes of securing a high-value asset to improve their standing.

The Endowment Effect and User Investment

Another critical psychological factor is the endowment effect, which describes how individuals value items more highly simply because they own them. Users spend hundreds of hours customizing teams and optimizing synergies between different digital athletes. This significant investment of time creates a psychological barrier to exit that competitors find difficult to break. A player is far less likely to abandon a platform where they have built a personalized collection that reflects their strategic decisions. Therefore, the retention rate increases in direct correlation with the time spent managing these virtual assets.

Market Dynamics and the Balance of Virtual Economies

Controlling Inflation Through Currency Sinks

A functioning in-game economy requires a delicate balance between resource generation and resource destruction to prevent hyperinflation. If the currency becomes too abundant, the value of individual items plummets effectively reducing the incentive to play. Developers must therefore implement currency sinks to remove excess liquidity from the system permanently. A common example includes a transaction tax on the peer-to-peer auction house or transfer market. This mechanism ensures that the pursuit of better equipment or players remains a challenging and meaningful endeavor for the entire lifecycle of the game.

Supply and Demand Principles in Digital Marketplaces

The secondary market within these games operates on strict supply and demand principles similar to real stock exchanges. Rare items with high performance statistics command premium prices due to their scarcity and utility. Market fluctuations occur based on real-world events, such as a player performing well in an actual match. Astute users monitor these trends to buy low and sell high to increase their purchasing power. This adds a layer of meta-gaming where financial literacy becomes just as important as mechanical skill on the virtual pitch.

Transparency and Quality in Virtual Asset Ecosystems

The Importance of Sustainable Economic Models

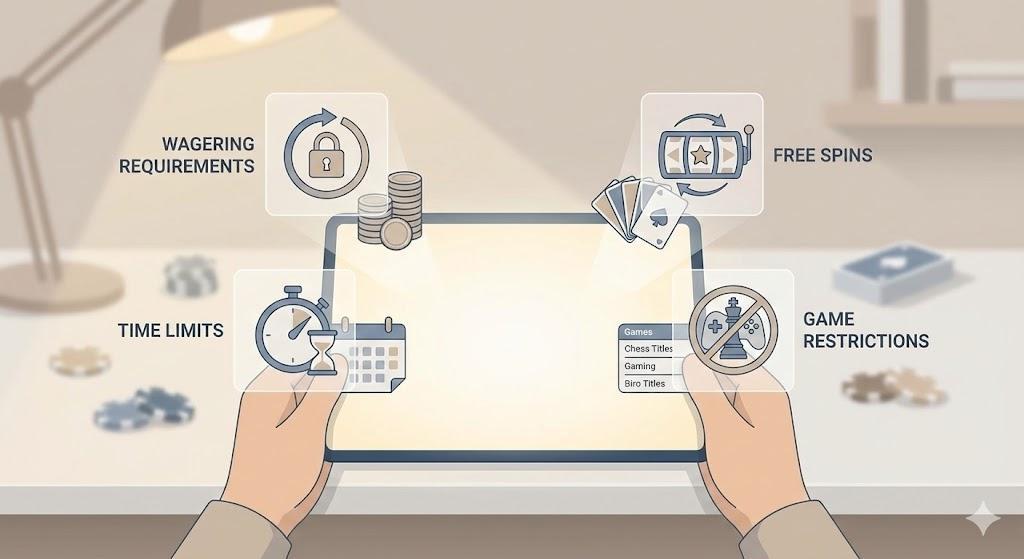

Sustainability in game economies relies on transparent drop rates and clear progression paths for the user base. Players need to trust that the time they invest yields a fair return in terms of digital value. Modern regulations increasingly require developers to disclose the probabilities associated with loot boxes and card packs. This shift towards transparency helps build a healthier relationship between the publisher and the consumer. Furthermore, a stable economy prevents pay-to-win mechanics from completely overshadowing skill-based progression.

Regional Considerations in Global Economies

Game economies often face challenges related to regional pricing and purchasing power disparities across the globe. Developers must adjust cost structures to ensure the game remains accessible in different economic zones. Failure to address these regional aspects can lead to grey markets or player exclusion. Successful titles manage to create a unified global market while acknowledging local economic realities. This approach ensures that the user base remains large enough to support quick matchmaking and a vibrant trade ecosystem.

Applying Gaming Economy Principles to Business Loyalty

Business leaders can observe these complex gaming structures to enhance their own customer loyalty programs effectively. Traditional point systems often lack the deep emotional engagement found in sports simulations. Companies should consider introducing elements of scarcity and asset management into their corporate reward schemes. For instance, allowing customers to trade points or customize their rewards adds a layer of strategy to the experience. This approach transforms a passive collection activity into an active engagement loop that drives brand interaction.

Furthermore, the concept of seasonal resets used in games can keep a loyalty program feeling fresh and urgent. Sports games often reset progress annually, which levels the playing field and renews the drive for achievement. Businesses could implement similar cyclical goals to prevent stagnation among long-term customers. By analyzing the flow of virtual currencies and the psychology of asset accumulation, companies can design more compelling systems. Ultimately, the goal is to create a sense of progression and ownership that rivals the most successful digital entertainment products.