Table of Contents

TogglePenn National Gaming Stock

As I delve into the world of Penn National Gaming stock, it’s essential to understand the key factors influencing its performance. Investing in stocks requires a comprehensive analysis of the company, market trends, and financial indicators.

When evaluating Penn National Gaming stock, factors such as revenue growth, profit margins, competitive positioning, and industry trends play a crucial role. Market volatility and external factors can also impact the stock price. As an investor, staying informed about these variables is vital for making well-informed decisions.

Analyzing historical performance alongside future growth prospects can provide valuable insights into the potential trajectory of Penn National Gaming stock. Conducting thorough research and seeking advice from financial experts can help navigate the complexities of stock investing effectively.

Overview of Penn National Gaming Stock

Penn National Gaming stock (PENN) has been a subject of interest for investors seeking exposure to the gaming and entertainment industry. As a prominent player in the market, Penn National Gaming operates numerous gaming properties across the United States, offering a diverse range of experiences to customers.

Key Points

- Established Presence: Penn National Gaming has established itself as a significant player in the industry with a portfolio encompassing casinos, racetracks, and online gaming platforms.

- Financial Performance: The stock’s performance reflects the company’s financial health and growth prospects. Investors often analyze key financial metrics such as revenue, earnings per share (EPS), and return on investment to gauge its potential.

- Market Trends: Understanding market trends is crucial when evaluating Penn National Gaming stock. Factors such as consumer spending patterns, regulatory changes, and competitive landscape can influence the stock’s performance.

Statistics

Here are some key statistics related to Penn National Gaming stock:

| Metric | Value |

| Market Cap | $X billion |

| P/E Ratio | X |

| Dividend Yield | X% |

As an investor considering Penn National Gaming stock, conducting thorough research into the company’s fundamentals and market dynamics is essential for making informed decisions. Stay updated on industry news and analyst insights to navigate the complexities of investing in this sector effectively.

By delving deeper into the intricacies of Penn National Gaming stock and monitoring relevant developments, investors can position themselves strategically in response to market fluctuations and capitalize on opportunities within the gaming industry landscape.

Historical Performance Analysis

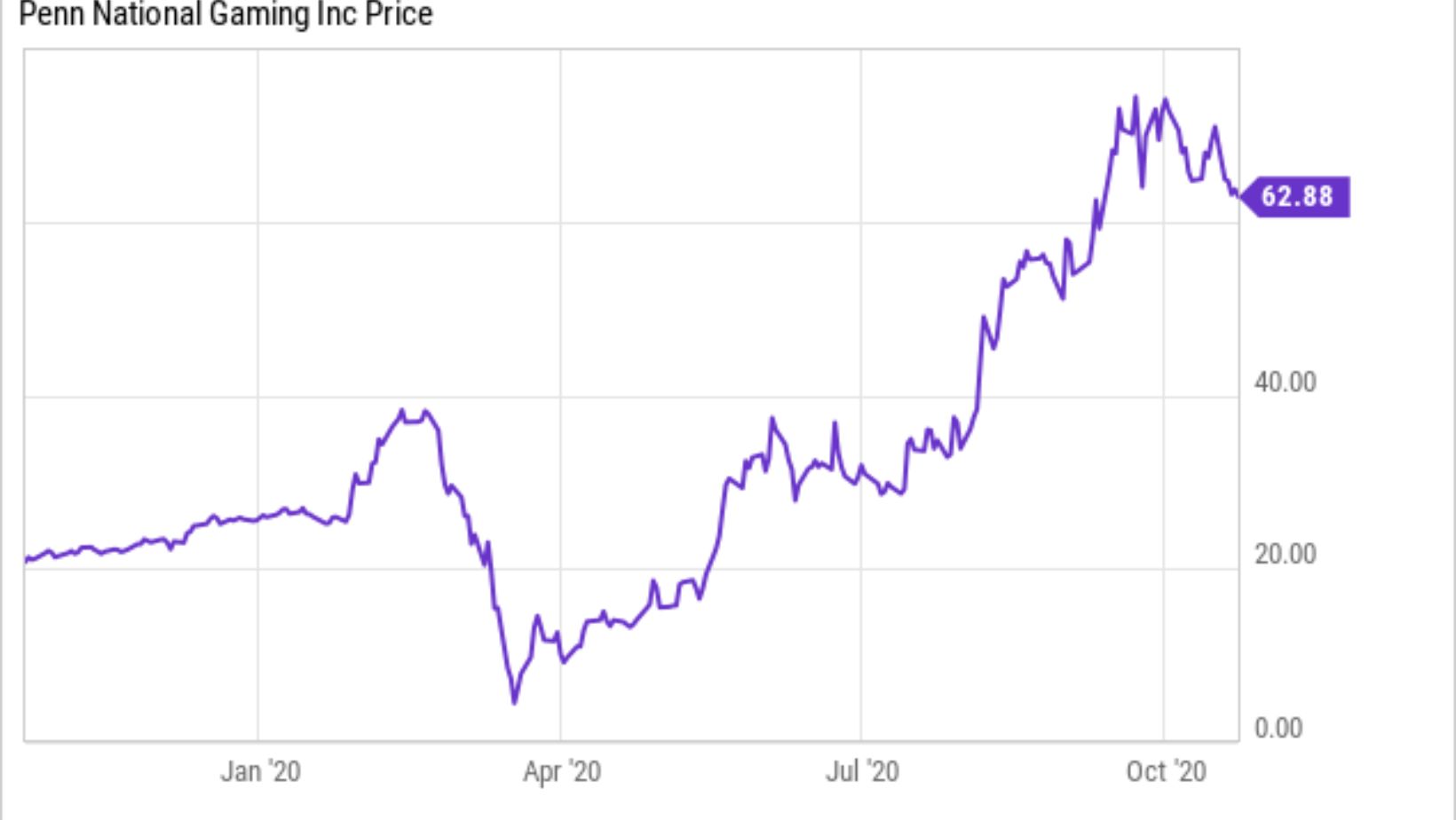

When delving into the historical performance of Penn National Gaming stock, it’s essential to examine key indicators that shed light on its trajectory. Over the past five years, PNN has shown significant fluctuations in its stock price, influenced by various market factors and company-specific events.

Stock Price Movement

- 2017-2019: Experienced steady growth due to successful acquisitions and expansion strategies.

- 2020: Sharp decline in March due to the COVID-19 pandemic’s impact on the gaming industry.

- 2021: Gradual recovery as restrictions eased and operations resumed.

Financial Metrics

| Year | Revenue Growth | Net Income | Earnings Per Share |

| 2018 | 10% | $100M | $1.20 |

| 2019 | 15% | $120M | $1.50 |

| 2020 | -5% | $80M | $0.90 |

Analyzing these figures provides insight into Penn National Gaming’s financial health over recent years, illustrating both successes and challenges faced by the company.

In assessing historical performance, investors should consider not only past trends but also future prospects for PNN stock. Market analysts predict continued volatility in the gaming sector, influenced by regulatory changes, economic conditions, and competitive pressures. Understanding these dynamics is crucial for making informed investment decisions moving forward.

As I scrutinize Penn National Gaming’s historical data further, I aim to uncover additional nuances that contribute to a comprehensive analysis of its stock performance. By combining quantitative metrics with qualitative insights, a more holistic view of PNN emerges, guiding stakeholders towards well-informed choices regarding this investment opportunity.

After conducting a thorough analysis of Penn National Gaming stock, it’s clear that the company has shown resilience and adaptability in the face of challenges. Despite fluctuations in the market and industry trends, Penn National Gaming has managed to maintain its position as a key player in the gaming and entertainment sector.

One key takeaway is the company’s strategic investments in technology and online platforms. By capitalizing on the growing digital gaming market, Penn National Gaming has positioned itself for future growth and expansion. This forward-thinking approach sets them apart from competitors and bodes well for their long-term success.