Digital transformation revolutionizes personal finance management through automated tracking and intelligent spending analysis. Traditional spreadsheet methods give way to sophisticated applications that connect directly to bank accounts and credit cards. These platforms categorize transactions automatically while providing real-time insights into spending patterns and budget performance. Entertainment expenses including subscriptions to services like 1king require careful monitoring within discretionary spending categories to maintain overall financial health. Modern budgeting tools help users identify unnecessary expenditures while building sustainable savings habits through data-driven recommendations.

Table of Contents

ToggleAutomated Expense Tracking and Categorization

Digital budgeting platforms offer comprehensive tracking features including:

- Automatic transaction categorization using merchant databases and spending history analysis;

- Real-time budget alerts delivered through mobile notifications and email updates;

- Bill reminder systems with integrated payment processing capabilities;

- Subscription tracking services identifying recurring charges and cancellation opportunities;

- Goal-based savings automation transferring funds based on predetermined financial targets.

These systems generate detailed spending reports showing monthly trends, category breakdowns, and variance analysis compared to budget allocations. Custom budget categories accommodate unique financial situations while template options provide quick setup for common expense types. Advanced analytics identify opportunities to reduce costs and increase savings rates through spending optimization recommendations.

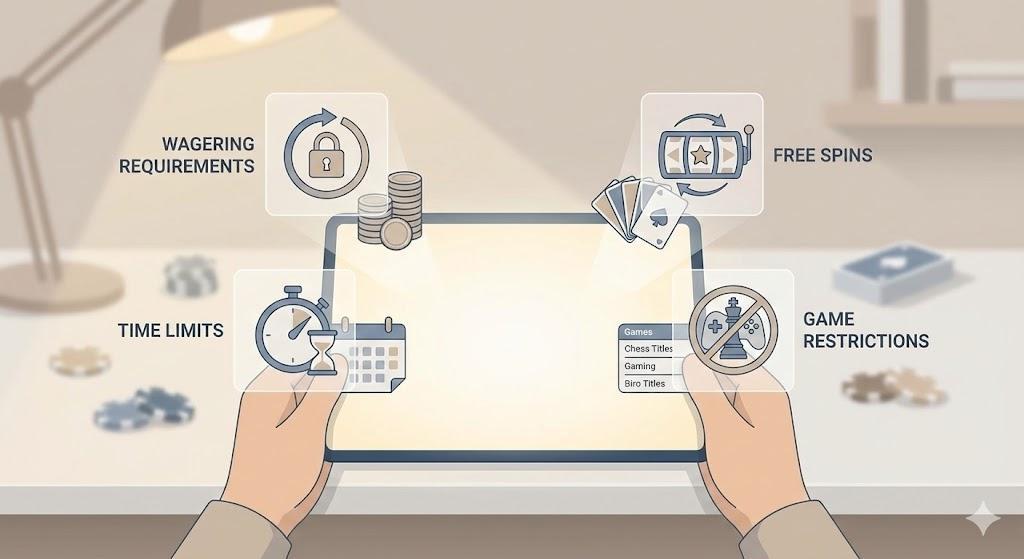

Investment Integration and Financial Goal Planning

Modern budgeting applications connect seamlessly with investment accounts to provide comprehensive financial overviews. These platforms track portfolio performance alongside daily spending to ensure balanced wealth building strategies. Automated investment features enable systematic contributions to retirement accounts and emergency funds based on available surplus income.

Integrated financial planning tools encompass:

- Investment account synchronization displaying portfolio values and performance metrics;

- Retirement planning calculators projecting future wealth based on current savings rates;

- Emergency fund tracking ensuring adequate reserves for unexpected expenses;

- Debt payoff strategies optimizing payment schedules to minimize interest costs;

- Tax planning assistance categorizing deductible expenses and estimating liability.

Goal-based budgeting frameworks help users allocate funds toward specific objectives like home purchases, vacation planning, or education expenses. Automated contribution scheduling ensures consistent progress toward financial milestones while maintaining operational budget requirements.